Value of preferred stock calculator

This cost of preferred stock calculator shows you how to calculate the cost of preferred stock given the dividend stock price and growth rate. CommonPreferred Stock Shares issued PAR Value Paid in Capital in excess of value common preferred stock Value received-Par value of the stock As per general accounting rule we have to ensure that our Debits Our Credits Popular Course in this category.

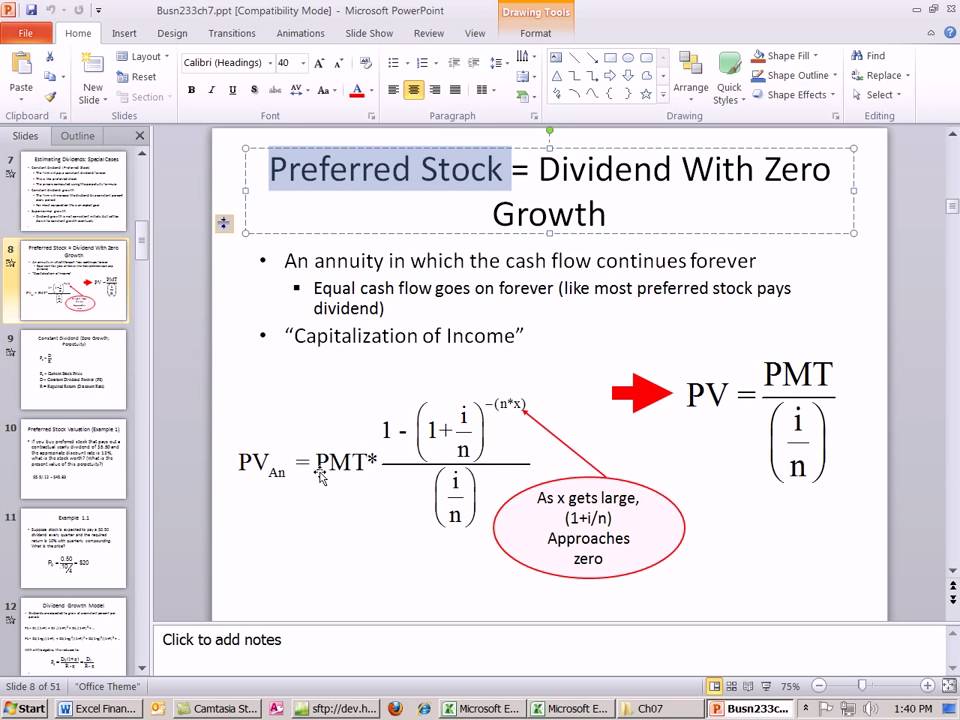

How To Calculate The Value Of A Preferred Stock In Microsoft Excel Microsoft Office Wonderhowto

What is the use of Preferred Stock Calculator.

. Know how much your company is worth. If a share of preferred stock has a par value of 100 and pays. Perpetuity Yield PY Present Value of Perpetuity PVP and Perpetuity Payment PP Calculator.

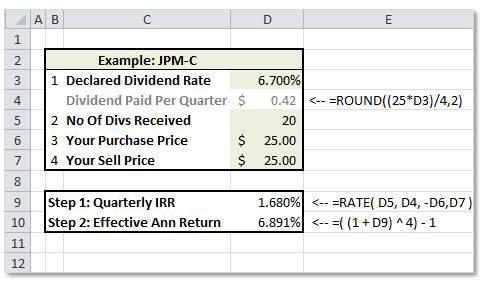

Calculate Yield to Call. To use this online calculator for Preferred Stock enter Dividend D Discount Rate r and hit the calculate button. Discounted Payback Period DPP Calculator.

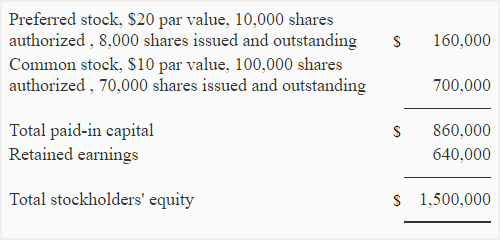

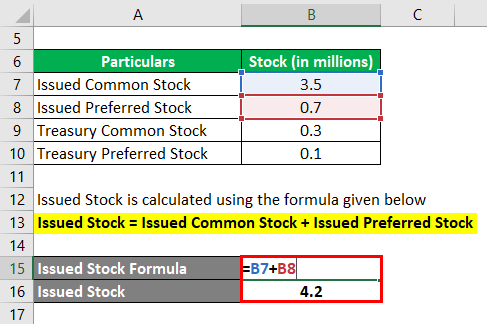

100000 23000 60000 193000. Download the Free Template. Calculating the Price of Perpetual Preferred Stock.

Book value per share Total equity Preferred shares Average of outstanding ordinary shares. Future Value FV Calculator. In other words its the amount.

Future Value Factor FVF Calculator. The following equation is used to calculate the cost of preferred stock. Our Financial Advisors Offer a Wealth of Knowledge.

FAQ What is Preferred Stock. This calculator will compute the book value per share for a companys preferred stock given the liquidation value of the preferred stock the amount of preferred dividends in arrears and the number of shares of preferred stock outstanding. If the current stock price is 21 the price of preferred stock is calculated as follows.

In other words par value is the face value of one share of stock. Cost of Preferred Stock Calculator This Excel file can be used for calculating the cost of preferred stock. An individual is considering investing in straight preferred stock that pays 20 per year in dividends.

Latest Calculator Release Average Acceleration Calculator. Considering that preferred stock calculations are growing increasingly sophisticated it is advised to utilize a specialized application. CPS DPS PPS 100 Where CPS is the cost of preferred stock DPS is the dividends per share PPs is the current price per share Cost of Preferred Stock Definition.

Present Value PV Calculator. Use our below online cost of preferred stock calculator by inserting the appropriate values on the input boxes and they clicking calculate button for finding the output. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P.

In this case we need to factor in both common stock and preferred stock in the calculation. Ad Calculate the impact of dividend growth and reinvestment. Preferred Stock Value Dividend per Preferred Stock Rate of Return Let us solve it out using the calculator.

The rate of tax is 20. I Pinimg Com. If the preferred stock has an annual dividend of 5 with a 0 growth rate meaning that the company.

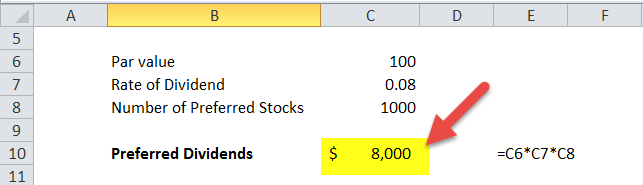

Rp 3 21 2 1657. Par value of one share of preferred stock equals the amount upon which the dividend is calculated. Suppose that you buy 1000 shares of preferred stock at 100 per share for a total investment of 100000.

Click the Year to select the Call Date enter coupon call and latest price then Calculate. Present Value PV and Future Value FV Number of Periods Calculator. Heres an easy formula for calculating the value of preferred stock.

Simply enter the dividend annual the stock price most recent and the growth rate or the dividend payments this is an optional field. Cost of Preferred Stock Calculator. The formula to calculate cost of preferred stock is given by.

Annual Dividend Rate Rate of Return Par Value of Share. Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal. Preferred Stock Value 100 0005.

If we consider the same example only this time the company issued 2000 preferred stocks at 30 per share. Preferred Stock Value 100 0005 So when the factors are specified and are as given in the table above the value of the preferred stock in concern would be Rs2000. Here is how the Preferred Stock calculation can be explained with given input values - 2083333 2512.

You calculate a preferred stocks dividend yield by dividing the annual dividend payment by the par value. It has been determined that based on risk the discount rate would be 5. Here is the formula.

The price the individual would want to pay for this security would be 20 divided by 05 5 which is calculated to be 400. Each share of preferred stock pays a 5 dividend resulting in a 5 dividend yield you get this percentage by dividing the 5 dividend by the 100 stock price. Its to learn how to calculate preferred stock value because all you.

Ad Discover Investment Options that Align with Your Goals. Preferred Stock Valuation Calculator You can use the preferred stock calculator below to quickly calculate a companys price or value of preferred stock in relation to its annual dividend per share of preferred stock and the rate of return required by entering the required numbers. Contact a Financial Advisor.

If the current price of the companys preferred stock is 8000 then the cost of preferred stock is equal to 50. Searching for Financial Security. Calculate the cost under each option and suggest which option is better.

The book value per share of preferred stock represents the amount of shareholders equity that is clearly assignable to preferred stock on a. Ad Online Valuation Calculation in less than 1 Hour. If we add in the total value of preferred stocks 60000 The new stockholder equity amounts to.

The cost of preferred stock to the company is effectively the price it pays in return for the income it gets from issuing and selling the stock. Cost of Preferred Stock 400 8000 50 Nuances to the Cost of Preferred Stock Sometimes preferred stock is issued with additional features that ultimately impact its yield and the cost of the financing. For example flotation is 90 and bond price is 900 so put down 10 not 10 here.

The CPS for shares is calculated as CPS for Shares Expected Dividend Market Price CPSk for Shares 50 5000 100 CPS for Shares.

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Common Stock Formula Calculator Examples With Excel Template

Preferred Dividend Definition Formula How To Calculate

Shares Outstanding Formula Calculator Examples With Excel Template

How To Calculate The Value Of A Preferred Stock In Microsoft Excel Microsoft Office Wonderhowto

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Cost Of Preferred Stock Equity Financing In Startups Plan Projections

Preferred Stock Returns Convertible Vs Participating Calculator Excel Template

Preferred Stock Pv Formula With Calculator

Preferred Stock Returns Convertible Vs Participating Calculator Excel Template

How To Calculate Book Value Per Share Bvps Calculation

Determining The Value Of A Preferred Stock

Step By Step Tutorial For Calculating Weighted Average Cost Of Capital Wacc Stockbros Research

Cost Of Preferred Stock Rp Formula And Calculator Excel Template